Cleanest public sector in the world: Keeping fraud at bay

New Zealand generally has a “clean” image when it comes to fraud. We consistently rank well in international and domestic surveys that measure public trust in government and the effectiveness of systems and processes that deal with fraud and corruption.1 Our general absence of systemic large-scale corruption in both the private and public sectors is attributed to the integrity of our system, underpinned by strong and shared common values within a small and cohesive society.

To date, most of the New Zealand-based surveys on fraud have focused on the private sector. To gain better insight into fraud awareness, prevention, and detection in our public sector, my Office commissioned PricewaterhouseCoopers (PwC) to carry out a survey of almost 1500 people working in the public sector. The survey response rate of 74% places the results among the most reliable information sources about perceptions and practices in detecting and preventing fraud in the public sector.

Strong commitment to protecting public resources

Overall, our survey confirms a strong commitment within the public sector to protecting public resources. This is pleasing and not surprising. However, we cannot afford to be complacent if we are to maintain our good record of keeping fraud at bay.

Despite our generally “clean” image, fraud is a fact of business life in New Zealand. According to a 2009 survey, 42% of New Zealand organisations (public and private) have suffered from an economic crime in the previous 12 months (August 2008 to August 2009), with an average loss of almost $492,000.2

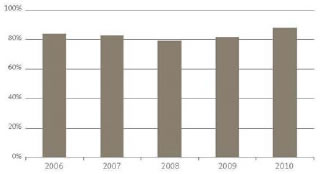

New Zealand’s score on the Transparency International Corruption Index for the five years from 2006 to 2010

In 2010, New Zealand was rated first equal with Denmark and Singapore. New Zealand has achieved a high place on the index since it started in 1995.

Ongoing vigilance is particularly important in the current global economic climate, which increases the risk of fraud as many people struggle to make ends meet.

Keeping up our good record

Our survey showed that the incidence of fraud is lowest where a public entity’s culture is receptive to talking about and dealing openly with fraud, where the entity communicates about fraud policies and risk, and where incidents of fraud are reported.

Anyone who has been part of an organisation that been defrauded knows that the financial loss is only part of the effect of fraud. Additional costs include loss of trust in workmates and colleagues, the loss in productivity when assessing and repairing internal systems, and the sense of betrayal.

The results of our survey show that there are some simple steps that we can all take to actively protect organisations and the public sector from fraud.

Within organisations, I encourage public entities to talk to their employees to promote fraud awareness and existing policies and procedures – and to do so regularly. I also want public entities to actively consider reporting each case of suspected fraud to enforcement agencies. Not every case will result in prosecution but reporting allows the system to work as intended and sends a strong message about an organisation’s zero tolerance for fraud. This also helps protect the public sector as a whole.

Sharing our knowledge about fraud risks can protect the public purse

Everyone working in the public sector is responsible for protecting our entities and public resources. Therefore, we need to recognise that preventing fraud means focusing on fraud risks. We can learn just as much, if not more, about these risks from our detected frauds as we can from the smaller number of cases that are reported.

At present, as part of every audit, my auditors ask public entities about fraud. They do this to make sure they are carrying out a professional audit. It is important to note that fraud prevention and detection is the responsibility of the governing body and management of each entity – not of the auditor.

In future, using the information that auditors receive from public entities, my Office will be regularly updating and sharing information about the fraud advised to us, similar to the way we’ve collected and set out the results of this survey.

We consider that sharing information more quickly about fraud will help all public entities learn about fraud incidents and risks, without compromising the principle of fairness. Public entities can support this by taking the simple step of informing their auditor quickly when they suspect that fraud has occurred. By sharing information quickly, we can identify and minimise our risks, limiting possible losses while working in ways that play to the strengths that continue to protect us – our sense of community and values.

This survey is a first step in what I hope will become an ongoing conversation about how we can all protect the public purse to get better value for every dollar used by the public sector. We’re putting together results by sector and entity size to help public entities get more insight. We’ll be sending out these sector results between now and Christmas, and my auditors are looking forward to discussing them with you.

Lyn Provost

Controller and Auditor-General

2 November 2011

1: For example, in 2010, we again ranked first (equal with Denmark and Singapore) on the Transparency International Corruption Index and achieved 99.5% on the Worldwide Governance Indicator for Control of Corruption.

2: The results of the 2009 PwC Global Economic Crime Survey were based on responses from more than 3000 companies in 54 countries. In New Zealand, 85 organisations from the private and public sectors took part in the survey. Full results can be found on the PwC website – www.pwc.com.