Part 1: Introduction

1.1

In this Part, we:

- explain what the national electricity grid (the grid) is;

- set out the role of Transpower New Zealand Limited (Transpower) with the grid;

- explain the regulatory context for Transpower, particularly in relation to its investment in grid assets;

- define risk management and set out the standards and guidelines for managing risk;

- set out the scope of this audit; and

- describe how we did the audit.

What is the grid?

1.2

The grid is a national network of high voltage electricity transmission assets. It comprises:

- 11,812 route kilometres of high voltage transmission line;

- 41,450 supporting towers and poles;

- 182 substations; and

- 1122 transformers.

Transpower's role with the grid

1.3

Transpower, a State-Owned Enterprise, owns and operates the grid.

1.4

Transpower is responsible for:

- transmitting electricity from where it is generated (by companies such as Meridian Energy Limited and Mighty River Power Limited) to cities, towns, and some major industrial users (like New Zealand Steel Limited);

- supplying lines companies (such as Vector Limited) that deliver electricity to New Zealand's homes and businesses; and

- managing New Zealand's power system (as the system operator) so that electricity is delivered when and where it is needed, 24 hours a day, seven days a week.

1.5

Transpower is responsible for ensuring that the grid is kept in good condition. This includes refurbishing or replacing transmission assets, where needed.

1.6

Transpower contracts out all its construction, maintenance, and fault response services. Transpower's five maintenance contractors operate in 13 regions.

1.7

Transpower is responsible for planning to ensure that the grid is able to meet the needs of future generations. Planning involves predicting the level and location of growth in electricity generation and demand, and investing in additional transmission assets to meet this future need.

1.8

Three of Transpower's divisions have core responsibility for carrying out these roles:

- Grid Development – responsible for identifying the future needs of the grid's users, developing transmission solutions, obtaining board and regulator approval for investments, and maintaining customer relationships;

- Grid Projects – responsible for carrying out Grid Development's projects and the asset replacement programmes for Grid Performance, managing capital works, procurement, and getting environmental approvals; and

- Grid Performance – responsible for grid safety, maintaining and operating the grid, managing power outages, managing assets, response and recovery from outages, monitoring grid performance, and relationships with landowners.

Background to the glide path strategy

1.9

In 1994, Transpower was established as a State-Owned Enterprise after the split of the Electricity Corporation of New Zealand into separate business entities.

1.10

In 1997, it was thought that distributed generation would expand quickly, meaning there would be no need to expand the grid or, possibly, even to maintain it in the longer term.1 Transpower made a strategic decision to adopt a "wait and see" approach. Transpower minimised spending on developing the grid and renewing assets as it set out on what became known as the glide path.

1.11

By 2003 and the appointment of a new chief executive, it had become clear that the expected expansion of distributed energy was unlikely to occur and the glide path was unsustainable.

Transpower's response

1.12

Transpower realised that it needed to start investing significantly to ensure that the grid had sufficient capacity to meet projected future electricity requirements. Transpower began work to identify a 40-year strategy to upgrade the grid and began building new transmission lines and substations.

1.13

Two discussion papers, in December 2003 and October 2004, examined New Zealand's likely electricity transmission needs until 2040.2 It was recognised that the grid's main transmission routes (the grid backbone), built largely in the 1950s and 1960s, were nearing capacity and investment was needed in almost every part of the grid.

1.14

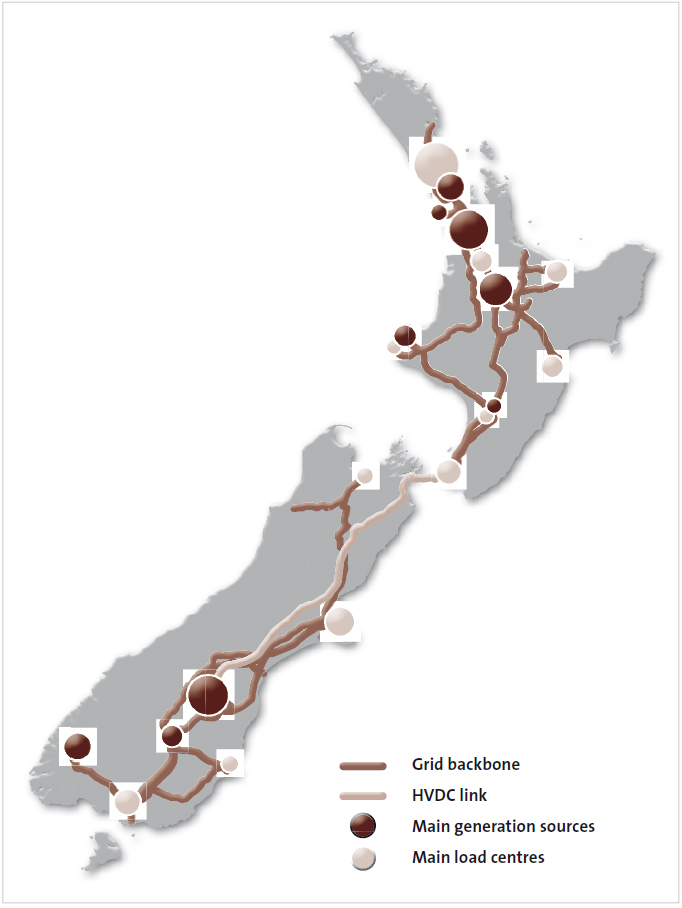

Figure 1 shows the grid backbone, High Voltage Direct Current (HVDC) link, main generation sources, and main load centres. The brown circles do not represent single generation sources. For example, the large circle in the south-central part of the South Island represents a large area of the South Island hydroelectric scheme including the Benmore and Waitaki power stations. The dark brown circle in the central North Island includes the geothermal power stations around Taupo and the hydroelectric power stations in the area.

Figure 1

The national electricity grid

1.15

Three priorities were identified:

- supply to Auckland and the upper North Island;

- supply to Christchurch and the upper South Island; and

- upgrading the HVDC inter-island link.

1.16

The 2004 discussion paper also signalled that Transpower would carry out other upgrades to meet projected growth in demand and allow enough time to introduce needed long-term solutions.

1.17

Transpower's decision to expand the grid coincided with the setting up of the Electricity Commission in September 2003. This meant that, while Transpower was entering a new phase and building its capacity and capability to carry out the significant investment required, the Electricity Commission was also settling into its new role and establishing a new regulatory environment. Part of the Electricity

Commission's regulatory role was to approve investment in the grid.

The regulatory framework

1.18

When investing in assets, Transpower must operate within a regulatory framework that applies to this spending. Transpower recovers its operating and capital spending from transmission customers through the transmission pricing methodology.

1.19

In November 2010, the Electricity Industry Act 2010 repealed and replaced the previous regulatory framework set up under the Electricity Act 1992. The Electricity Industry Participation Code (the code) and the Electricity Industry (Enforcement) Regulations 2010 replaced the Electricity Governance Rules (made by the Minister of Energy) and the Electricity Governance Regulations 2003.

1.20

Before November 2010, Part F of the Electricity Governance Rules set out the requirements for grid upgrades and investments. Transpower was required to prepare, and submit to the Electricity Commission, grid upgrade plans which met the requirements of Part F. These plans set out and justified the planned investment.

1.21

The new code includes large sections of Part F of the former Electricity Governance Rules. The responsibility for setting the requirements for Transpower's capital expenditure and approving such spending has been passed to the Commerce Commission.

1.22

Appendix 1 contains more detail about the regulatory framework and the changes that have occurred. It also includes details about the tests for Transpower's proposed investments.

Standards and guidelines for managing risk

1.23

We have assessed Transpower's practices against the following standards and guidelines:

- Joint Australian New Zealand International Standard – Risk Management – Principles and guidelines AS/NZS ISO 31000:2009;

- Risk Management Guidelines HB 436:2004, a companion to AS/NZS 4360:2004;

- PAS 55-1:2008 (PAS 55), Asset management. Specification for the optimized management of physical assets, issued by the British Standards Institution; and

- Technical Brochure on Transmission Asset Risk Management published in August 2010 by Working Group C1.16 of the International Council on Large Electric Systems.

What is risk management?

1.24

AS/NZS ISO 31000:2009 describes risk and risk management as:

Organizations… face internal and external factors and influences that make it uncertain whether, when and the extent to which they will achieve or exceed their objectives. The effect this uncertainty has on the organization's objectives is "risk"…

All activities of an organization involve risk... In general terms, "risk management" refers to the architecture (principles, framework, and process) for managing risks effectively, and "managing risk" refers to applying that architecture to particular risks.

… the adoption of consistent processes within a comprehensive framework helps ensure that risk is managed effectively, efficiently, and coherently across an organization. … Risk management can be applied across an entire organization … as well as specific functions, projects, and activities.

What is asset management?

1.25

Asset management is the process of achieving whole-of-life effectiveness of assets at minimum cost. For an asset-intensive company like Transpower, operating the grid as an infrastructure network, the concept of risk and its management are closely related to the concept of asset risk and asset management. This is generally recognised in the standards and guidelines that apply to the management of risks and assets.

The scope of our audit

1.26

In carrying out our audit, we set out to answer the following question: How well is Transpower managing risk to the grid, to reduce the chances of power failure in the short term, and the chances of adopting an inadequate or excessive investment strategy for the medium to long term?

1.27

We expected that Transpower would:

- promptly identify all asset risks;

- appropriately assess and prioritise risks to grid assets;

- take appropriate, timely action to reduce risks to grid assets;

- take appropriate, timely action during and after unplanned events (risk recovery); and

- have the most effective investment strategy for reducing risk.

How we carried out our audit

1.28

In our audit, we:

- interviewed staff from Transpower and the Ministry of Economic Development;

- reviewed documents relating to what was discussed during the interviews;

- considered reports by external consultants and regulators;

- found out what systems Transpower had in place for identifying risks and taking appropriate action to prioritise and reduce them, including:

- assessing what information is used in managing risk and how this information is used;

- reading key strategies, risk registers, planning reports, and asset performance reports;

- reading Network Risk Committee meeting agendas and minutes to assess how effective the Committee was;3

- reviewed Transpower's investment approval process and how it identifies, prioritises, and reduces risks;

- established how Transpower follows up on unplanned power outages and failures, and assessed to what extent these are failures of the risk management process; and

- established what risk-recovery processes Transpower has, and how it determines whether these are appropriate.

1.29

We tested our conclusions with an independent advisor who has been involved in the electricity industry for 37 years. Our independent advisor also acted as an advisor to the team that performed the Ministerial Review of the Electricity Market in August 2009.

The structure of this report

1.30

The rest of this report is made up of three parts:

- In Part 2, we discuss and evaluate Transpower's system for managing risks to grid assets, and Transpower's planned improvements to how it manages risks to grid assets. Transpower has identified risks to contractors' capabilities. These risks could affect how the grid performs. We look at how Transpower is managing these risks. We also look at how well Transpower responds to unplanned events.

- In Part 3, we discuss how well Transpower uses its understanding of risks to grid assets to invest in the grid's capacity.

- In Part 4, we discuss and evaluate how well Transpower uses its understanding of risks to manage grid assets and improve the grid's reliability and performance.

1: Transpower does not have the role of central planner (there is no central planner), so it cannot influence where or when new generation is established.

2: Transpower New Zealand (2003), Future of the National Grid 2003-2004 Discussion Document and Transpower New Zealand (2004), Future of the National Grid Discussion Document No. 2.

3: See paragraph 2.26 and Appendix 2 for information about the Network Risk Committee.

page top